Whether you're a seasoned investor or just starting out, this guide will provide valuable insights into the world of Jepi and Qyld.

Investors often find themselves at a crossroads when deciding between Jepi and Qyld. While both offer attractive opportunities, they operate on different principles and serve distinct purposes. Jepi is known for its focus on high-dividend stocks, making it an ideal choice for those seeking steady income. On the other hand, Qyld emphasizes covered call strategies, which can be advantageous for those looking to generate additional returns in a volatile market. Understanding these differences is crucial for aligning your investments with your long-term financial goals.

As we delve deeper into the comparison of Jepi vs Qyld, we’ll examine their performance metrics, risk factors, and suitability for various investor profiles. By the end of this article, you’ll have a clear understanding of which option may be better suited for your investment strategy. Whether you're looking for stability, growth, or a combination of both, this guide will equip you with the knowledge you need to make a confident decision.

Read also:Jag One Rossville A Comprehensive Guide To Excellence And Expertise

Table of Contents

- What Are Jepi and Qyld?

- How Do Jepi and Qyld Work?

- What Are the Key Differences Between Jepi and Qyld?

- Which is Better: Jepi vs Qyld?

- Can Beginners Invest in Jepi or Qyld?

- What Are the Risks of Investing in Jepi and Qyld?

- How to Get Started with Jepi vs Qyld?

- What Experts Say About Jepi and Qyld?

- How to Evaluate Jepi vs Qyld Performance?

- Frequently Asked Questions About Jepi vs Qyld

What Are Jepi and Qyld?

Jepi, or the JPMorgan Equity Premium Income ETF, is an exchange-traded fund designed to provide investors with a steady stream of income through high-dividend stocks. It focuses on large-cap equities and employs a strategy that seeks to balance income generation with capital appreciation. This makes it an attractive option for investors who prioritize consistent returns over aggressive growth.

Qyld, or the Global X Nasdaq 100 Covered Call ETF, takes a different approach by utilizing a covered call strategy. This involves holding a portfolio of Nasdaq 100 stocks while simultaneously selling call options on those holdings. The goal is to generate additional income through option premiums, which can be particularly beneficial in sideways or slightly bearish markets.

How Do Jepi and Qyld Work?

Jepi operates by selecting a diversified portfolio of high-dividend-paying stocks. These stocks are typically from sectors like utilities, consumer staples, and healthcare, which are known for their stability and consistent payouts. The fund’s strategy is to provide investors with a reliable income stream while minimizing volatility.

Qyld, on the other hand, uses a covered call strategy to enhance returns. By selling call options on its holdings, Qyld generates additional income, which can offset potential losses during market downturns. However, this strategy also limits upside potential, as the fund must sell shares if the option is exercised.

What Are the Key Differences Between Jepi and Qyld?

When comparing Jepi vs Qyld, one of the most significant differences lies in their underlying strategies. Jepi focuses on dividend income, while Qyld emphasizes generating returns through options trading. This fundamental difference impacts their risk profiles, performance metrics, and suitability for various investor types.

Another key difference is the sectors they invest in. Jepi tends to favor stable, dividend-rich industries, whereas Qyld is heavily concentrated in the tech-heavy Nasdaq 100. This makes Qyld more volatile but potentially more rewarding in a bull market.

Read also:Discover Dominos Body Shop Your Ultimate Guide To Automotive Excellence

Which is Better: Jepi vs Qyld?

The answer to this question depends on your investment goals and risk tolerance. If you’re looking for a steady income stream with lower volatility, Jepi may be the better choice. However, if you’re comfortable with higher risk and want to capitalize on market volatility, Qyld could be more suitable.

Can Beginners Invest in Jepi or Qyld?

Both Jepi and Qyld are accessible to beginners, but it’s essential to understand their strategies before investing. Beginners should start with a small allocation and gradually increase their investment as they gain more experience and confidence.

What Are the Risks of Investing in Jepi and Qyld?

Like any investment, Jepi and Qyld come with their own set of risks. For Jepi, the primary risk is dividend cuts, which can occur if companies in its portfolio face financial difficulties. Qyld’s covered call strategy can also lead to missed opportunities for significant gains if the market rallies sharply.

How to Get Started with Jepi vs Qyld?

Getting started with Jepi or Qyld is relatively straightforward. You can purchase shares through any brokerage account that offers ETF trading. Before investing, make sure to review their prospectuses and understand their fee structures.

What Experts Say About Jepi and Qyld?

Financial experts often praise Jepi for its stability and consistent income generation. Qyld, on the other hand, is lauded for its innovative approach to generating returns through options trading. However, experts caution that both funds require careful consideration of market conditions and personal investment goals.

How to Evaluate Jepi vs Qyld Performance?

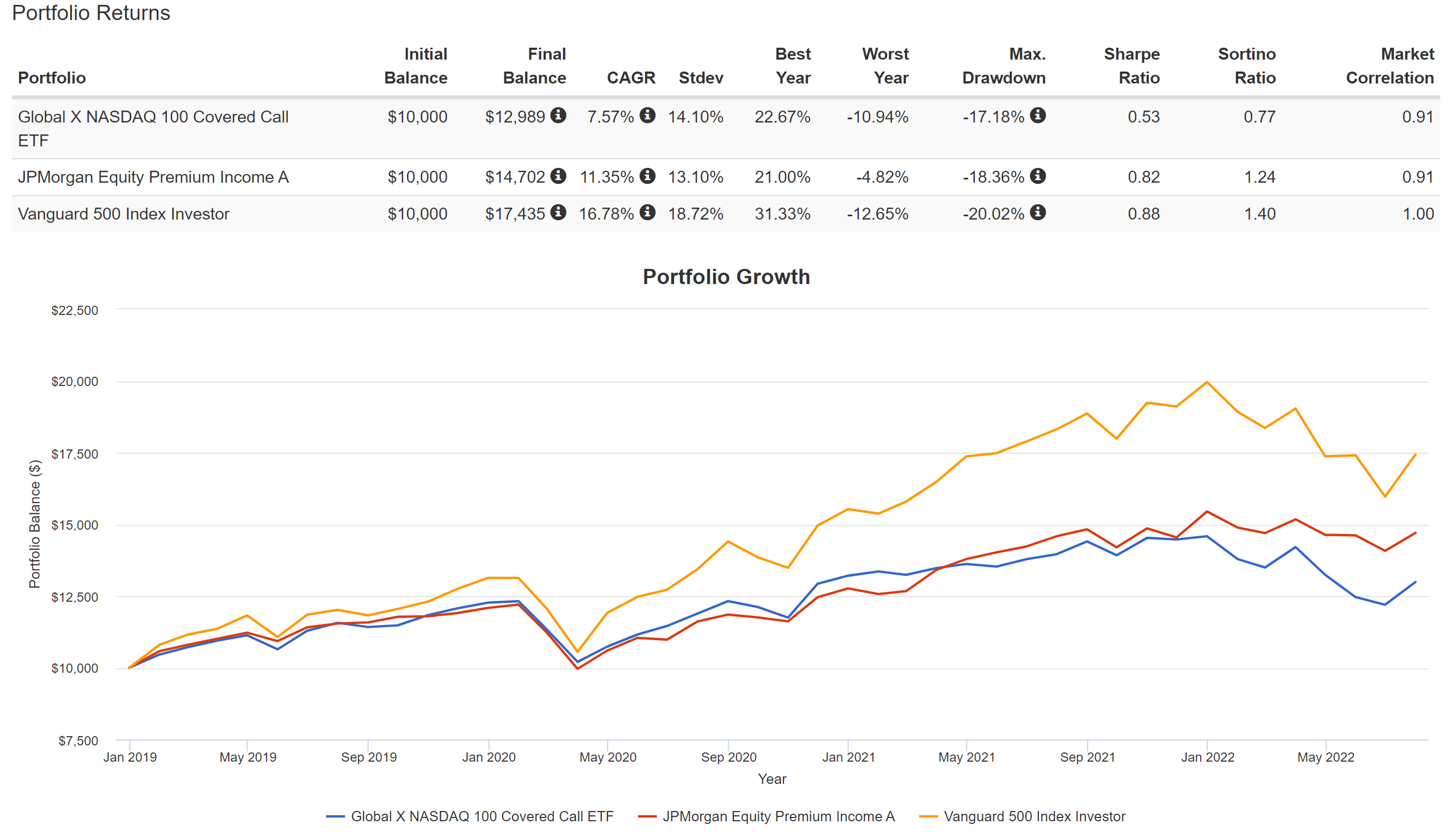

To evaluate the performance of Jepi vs Qyld, consider metrics such as total returns, dividend yields, and volatility. Historical performance data can provide insights into how each fund has fared under different market conditions.

Frequently Asked Questions About Jepi vs Qyld

- What is the main difference between Jepi and Qyld? The main difference lies in their strategies: Jepi focuses on dividend income, while Qyld uses a covered call strategy.

- Can I invest in both Jepi and Qyld? Yes, diversifying your portfolio with both can provide a balance of income and growth potential.

- Are Jepi and Qyld suitable for retirement portfolios? Both can be suitable, but Jepi may be better for those seeking stable income during retirement.

In conclusion, Jepi vs Qyld offers investors distinct opportunities to achieve their financial goals. By understanding their differences and aligning them with your investment strategy, you can make informed decisions that enhance your portfolio’s performance. Whether you choose Jepi, Qyld, or a combination of both, the key is to stay informed and regularly review your investments to ensure they continue to meet your needs.