Investors and financial analysts are increasingly turning their attention to Nasdaq SHLS financials as a key indicator of the company's performance and market standing. With the growing interest in sustainable energy solutions, SHLS has positioned itself as a significant player in the industry. Investors are keen to understand the financial health of the company, its revenue streams, and its ability to adapt to changing market conditions. This article delves into the financial aspects of SHLS, providing a detailed analysis of its performance on the Nasdaq exchange and offering insights into what makes this company a noteworthy investment opportunity.

For those unfamiliar with SHLS, it is a company that specializes in innovative energy solutions, leveraging cutting-edge technology to meet the demands of a rapidly evolving market. The company's financials are closely monitored by analysts and investors alike, as they provide a clear picture of its growth trajectory and profitability. Nasdaq SHLS financials have shown promising trends, with steady revenue growth and strategic investments in research and development. This article will explore the factors contributing to the company's financial success and what potential investors should consider before adding SHLS to their portfolios.

As we delve deeper into the financials of SHLS, we will examine key metrics such as revenue, expenses, and profit margins. These metrics are essential for understanding the company's financial health and its ability to compete in the energy sector. Additionally, we will explore how SHLS's performance on the Nasdaq exchange reflects broader market trends and investor sentiment. By the end of this article, readers will have a comprehensive understanding of Nasdaq SHLS financials and the factors that make this company a compelling investment opportunity.

Read also:Fire Champaign Illinois A Comprehensive Guide To Safety And Preparedness

Table of Contents

- What Are Nasdaq SHLS Financials?

- Why Should You Invest in SHLS?

- How Does SHLS Compare to Competitors?

- What Are the Key Financial Metrics of SHLS?

- Is SHLS a Stable Investment?

- How Has SHLS Performed on Nasdaq?

- What Are the Risks of Investing in SHLS?

- How Does SHLS Plan to Grow in the Future?

- What Do Experts Say About SHLS Financials?

- Conclusion: The Future of Nasdaq SHLS Financials

What Are Nasdaq SHLS Financials?

Nasdaq SHLS financials refer to the comprehensive financial data of SHLS, a company listed on the Nasdaq exchange. These financials include key metrics such as revenue, net income, expenses, and cash flow, which are critical for assessing the company's financial health. Investors use these metrics to evaluate SHLS's performance and determine its potential for future growth. Understanding Nasdaq SHLS financials is essential for anyone considering investing in the company or analyzing its market position.

Why Should You Invest in SHLS?

Investing in SHLS can be a strategic move for those looking to capitalize on the growing demand for sustainable energy solutions. The company has demonstrated a commitment to innovation and sustainability, which aligns with global trends toward cleaner energy sources. Nasdaq SHLS financials reveal a strong revenue growth trajectory, supported by strategic investments in research and development. Additionally, SHLS has a robust business model that positions it well for long-term success in the energy sector.

What Are the Key Financial Metrics of SHLS?

To fully understand Nasdaq SHLS financials, it's important to examine the key financial metrics that define the company's performance. These metrics include:

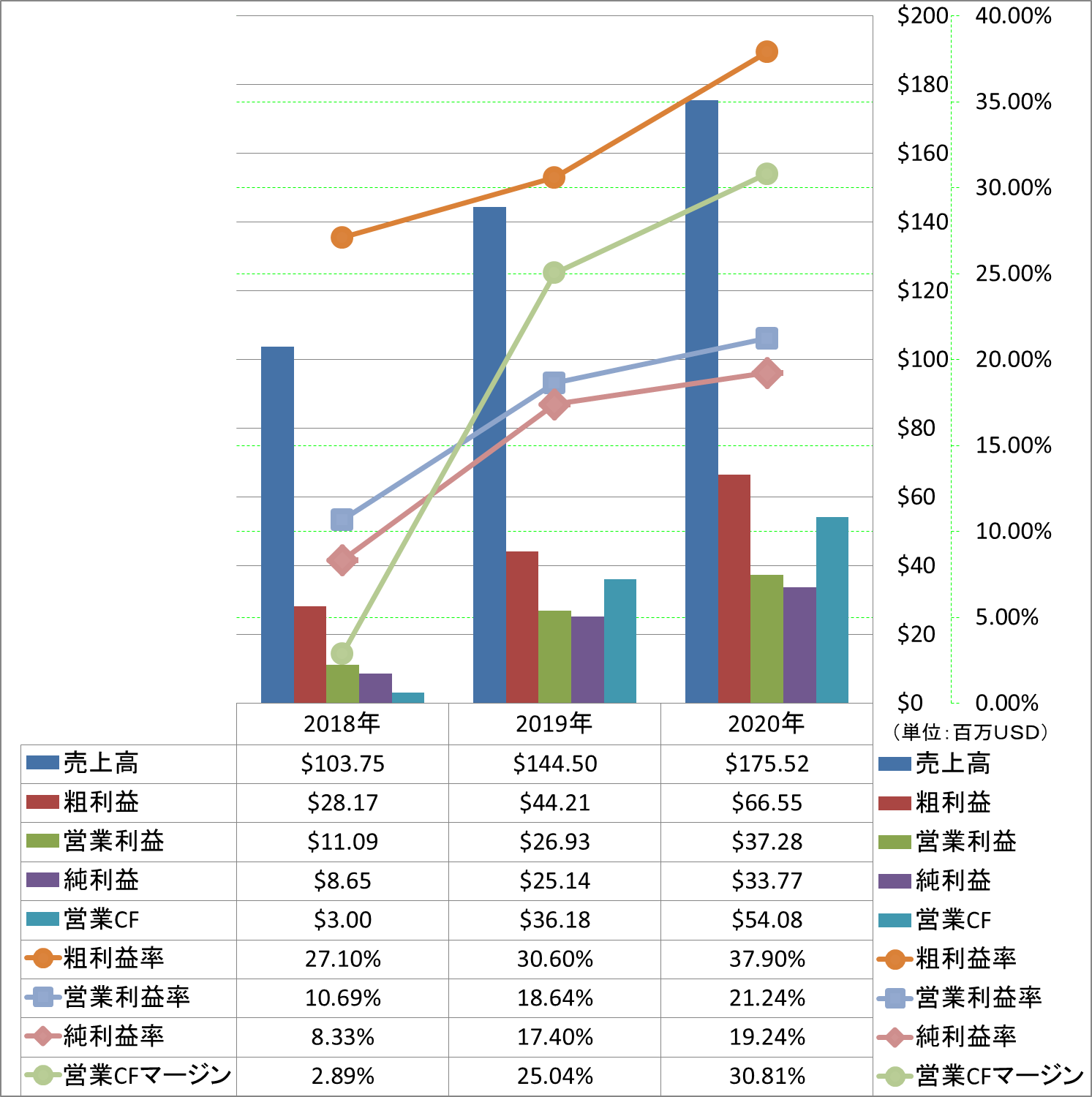

- Revenue Growth: SHLS has consistently shown year-over-year revenue growth, driven by increased demand for its products and services.

- Profit Margins: The company's profit margins have improved over time, reflecting its ability to manage costs effectively.

- Cash Flow: Positive cash flow is a strong indicator of SHLS's financial stability and its ability to fund future growth initiatives.

- Debt Levels: SHLS maintains a manageable level of debt, which reduces financial risk and enhances investor confidence.

How Does SHLS Compare to Competitors?

When evaluating Nasdaq SHLS financials, it's essential to compare the company's performance to its competitors in the energy sector. SHLS stands out for its innovative approach to energy solutions and its ability to adapt to changing market conditions. Unlike some of its competitors, SHLS has a diversified revenue stream, which reduces its reliance on any single market or product. This diversification is a key factor in the company's financial success and its ability to compete in a rapidly evolving industry.

Is SHLS a Stable Investment?

Investors often ask, "Is SHLS a stable investment?" The answer lies in the company's financials and its track record of performance. Nasdaq SHLS financials indicate that the company has a strong foundation, with consistent revenue growth and a focus on innovation. While no investment is entirely risk-free, SHLS's financial stability and strategic planning make it a relatively safe option for investors looking to enter the energy sector.

What Are the Risks of Investing in SHLS?

While Nasdaq SHLS financials paint a positive picture, it's important to consider the risks associated with investing in the company. These risks include:

Read also:Is Darktide Crossplay Everything You Need To Know

- Market Volatility: The energy sector is subject to fluctuations in demand and pricing, which can impact SHLS's financial performance.

- Regulatory Changes: Changes in government policies or regulations could affect the company's operations and profitability.

- Technological Disruptions: Rapid advancements in technology could render some of SHLS's products or services obsolete.

How Has SHLS Performed on Nasdaq?

SHLS's performance on the Nasdaq exchange has been closely monitored by investors and analysts. The company's stock price has shown resilience, even during periods of market volatility. Nasdaq SHLS financials reflect a strong correlation between the company's financial performance and its stock price, making it an attractive option for investors seeking long-term growth opportunities.

How Does SHLS Plan to Grow in the Future?

Looking ahead, SHLS has outlined several strategies for future growth. These include expanding its product offerings, entering new markets, and investing in research and development. By focusing on innovation and sustainability, SHLS aims to maintain its competitive edge in the energy sector. Nasdaq SHLS financials will play a crucial role in tracking the company's progress toward these goals and assessing its overall performance.

What Do Experts Say About SHLS Financials?

Financial experts have weighed in on Nasdaq SHLS financials, offering insights into the company's performance and future prospects. Many analysts praise SHLS for its strong revenue growth and strategic investments in technology. However, some caution that the company must remain vigilant in managing risks and adapting to market changes. Overall, the consensus is that SHLS is well-positioned for continued success in the energy sector.

Conclusion: The Future of Nasdaq SHLS Financials

In conclusion, Nasdaq SHLS financials provide a comprehensive view of the company's financial health and its potential for future growth. By examining key metrics such as revenue, profit margins, and cash flow, investors can make informed decisions about whether to invest in SHLS. With its focus on innovation and sustainability, SHLS is poised to remain a key player in the energy sector for years to come. As the company continues to grow and adapt, Nasdaq SHLS financials will serve as a valuable tool for tracking its progress and assessing its market position.