Vroom, an online platform for buying and selling used cars, has captured the attention of investors due to its innovative approach to the car-buying process. The company's stock performance reflects not only its operational success but also broader market trends, economic conditions, and consumer behavior. Whether you're a seasoned investor or a newcomer to the stock market, keeping an eye on Vroom's stock price can provide valuable insights into the future of digital car sales.

Vroom's business model revolves around streamlining the car-buying experience by offering a fully online platform. This approach has resonated with tech-savvy consumers, leading to significant growth in its user base. However, like any publicly traded company, Vroom's stock price is subject to fluctuations driven by earnings reports, market sentiment, and competitive pressures. Investors often analyze these factors to make informed decisions about whether to buy, hold, or sell Vroom shares.

As we delve deeper into the topic, we'll explore the factors influencing Vroom's stock price, its historical performance, and what analysts are saying about its future. By understanding the nuances of Vroom's financial health and market positioning, you'll be better equipped to assess its potential as an investment opportunity. Let’s break down the critical aspects of Vroom stock price to help you navigate the stock market with confidence.

Read also:Fayetteville Ga Water A Comprehensive Guide To Clean Water And Community Resources

Table of Contents

- What is Vroom Stock Price?

- Why Does Vroom Stock Price Fluctuate?

- How to Track Vroom Stock Price?

- Is Investing in Vroom Stock Price Worth It?

- Historical Performance of Vroom Stock Price

- What Analysts Say About Vroom Stock Price?

- Key Factors Affecting Vroom Stock Price

- How Does Vroom Stock Price Compare to Competitors?

- What Are the Risks of Vroom Stock Price?

- Final Thoughts on Vroom Stock Price

What is Vroom Stock Price?

Vroom stock price represents the value of a single share of Vroom Inc. on the stock market. As a publicly traded company, Vroom's stock is listed on the Nasdaq under the ticker symbol "VRM." The stock price is determined by supply and demand dynamics, influenced by factors such as investor sentiment, company performance, and broader economic conditions. Understanding the basics of Vroom stock price is crucial for anyone looking to invest in this innovative automotive platform.

Why Does Vroom Stock Price Fluctuate?

Vroom's stock price fluctuates due to a combination of internal and external factors. Internal factors include the company's financial performance, such as revenue growth, profitability, and operational efficiency. External factors may include changes in consumer demand, competition from other online car retailers, and macroeconomic trends like inflation or interest rates. These fluctuations can create opportunities for investors but also pose risks if not carefully analyzed.

How to Track Vroom Stock Price?

To stay updated on Vroom stock price, investors can use various tools and platforms. Stock market apps, financial news websites, and brokerage accounts provide real-time updates on Vroom's stock performance. Additionally, setting up price alerts can help you monitor significant movements in Vroom stock price, allowing you to make timely investment decisions.

Is Investing in Vroom Stock Price Worth It?

Investing in Vroom stock price requires a thorough understanding of the company's business model and market position. While Vroom has shown promise in disrupting the traditional car-buying process, it also faces challenges such as high operational costs and intense competition. Evaluating these factors can help you determine whether Vroom stock price aligns with your investment goals.

Historical Performance of Vroom Stock Price

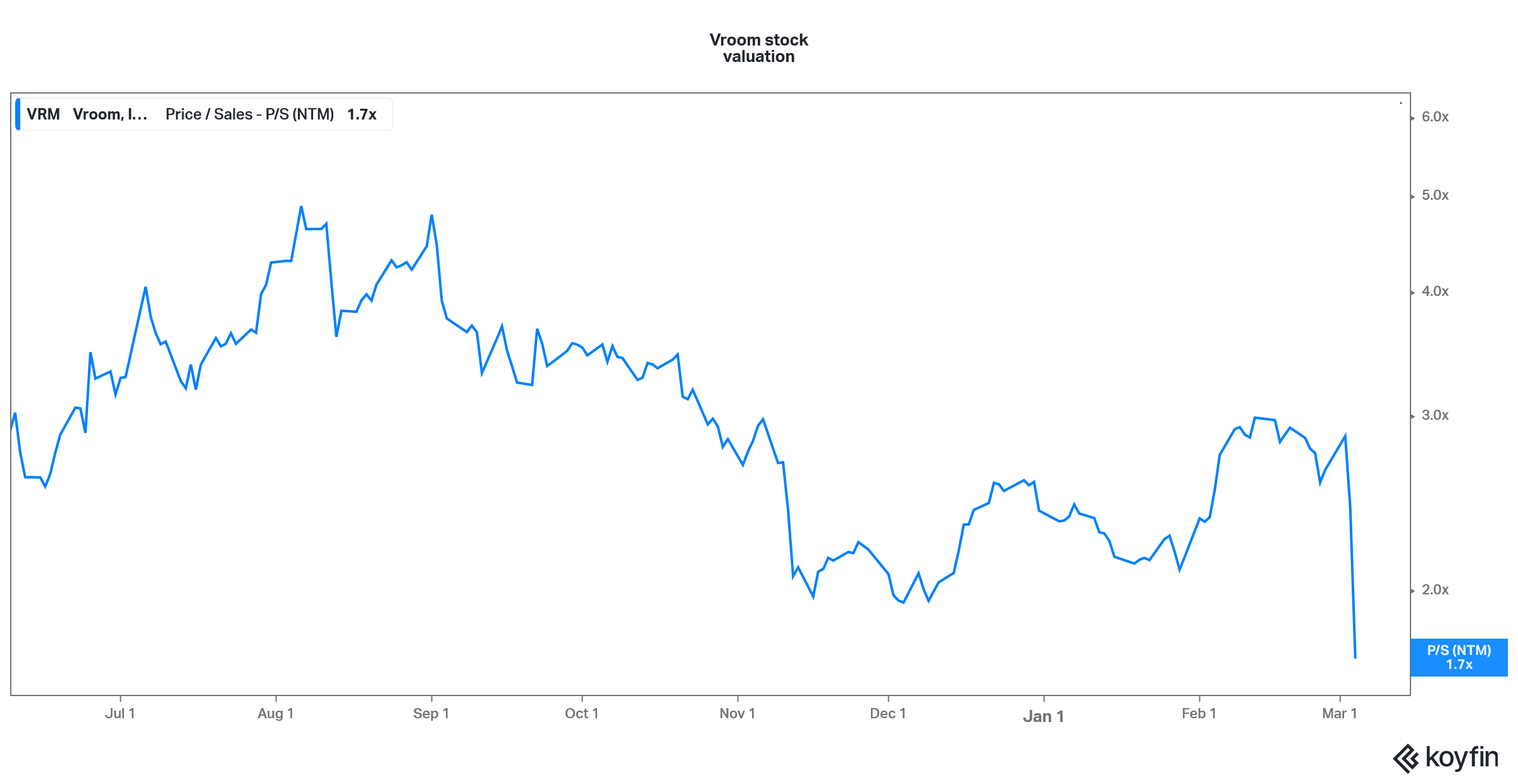

Vroom's stock price has experienced significant volatility since its initial public offering (IPO). In its early days, the stock price surged due to investor enthusiasm for its innovative platform. However, subsequent earnings reports and market conditions have led to fluctuations. Analyzing Vroom's historical stock price can provide insights into its potential future performance.

What Analysts Say About Vroom Stock Price?

Financial analysts closely monitor Vroom stock price to provide insights and predictions for investors. Some analysts are optimistic about Vroom's growth potential, citing its strong brand and expanding customer base. Others, however, caution against potential risks, such as rising operational costs and competitive pressures. Understanding these perspectives can help you make informed investment decisions.

Read also:Saint Laurent Condom Unveiling Style And Protection

Key Factors Affecting Vroom Stock Price

Several factors influence Vroom stock price, including the company's financial health, market trends, and consumer behavior. For example, strong quarterly earnings reports can boost investor confidence and drive the stock price higher. Conversely, negative news, such as supply chain disruptions or declining sales, can lead to a drop in Vroom stock price. Staying informed about these factors is essential for successful investing.

How Does Vroom Stock Price Compare to Competitors?

Vroom operates in a competitive market alongside companies like Carvana and Shift Technologies. Comparing Vroom stock price to its competitors can provide insights into its relative performance and market position. For instance, if Vroom's stock price is outperforming its peers, it may indicate stronger growth potential or investor confidence. However, underperformance could signal challenges that need to be addressed.

What Are the Risks of Vroom Stock Price?

Investing in Vroom stock price comes with certain risks, including market volatility, operational challenges, and competition. Additionally, external factors such as economic downturns or changes in consumer preferences can impact the stock price. Understanding these risks is crucial for mitigating potential losses and making informed investment decisions.

Final Thoughts on Vroom Stock Price

Vroom stock price is a dynamic indicator of the company's performance and market sentiment. While it offers exciting opportunities for growth, it also comes with risks that investors must carefully evaluate. By staying informed about the factors influencing Vroom stock price and leveraging tools to track its performance, you can make strategic investment decisions. Whether you're a long-term investor or a short-term trader, understanding Vroom stock price is key to navigating the stock market successfully.

In conclusion, Vroom's innovative approach to car sales has positioned it as a key player in the automotive industry. However, its stock price reflects both the opportunities and challenges of operating in a competitive and rapidly evolving market. By keeping a close eye on Vroom stock price and staying informed about the factors that influence it, you can make well-informed decisions about your investment strategy.