Investing in Southwest Gas stock requires understanding the company’s core operations, financial health, and future growth prospects. The company has a long-standing reputation for delivering reliable energy services while maintaining strong relationships with its customers. Southwest Gas is not just about distributing natural gas; it also focuses on sustainable energy solutions and innovative technologies to meet the evolving demands of the energy market.

Southwest Gas stock has shown resilience even during challenging economic conditions. With a focus on infrastructure upgrades, customer service, and regulatory compliance, the company has positioned itself as a reliable investment option. In this article, we will explore everything you need to know about Southwest Gas stock, including its performance, risks, and potential rewards. Whether you're a seasoned investor or just starting, this guide will help you make informed decisions about adding Southwest Gas stock to your portfolio.

Table of Contents

- Is Southwest Gas Stock a Good Investment?

- What Makes Southwest Gas Stock Unique?

- Southwest Gas Stock: Financial Performance

- How Does Southwest Gas Stock Handle Market Challenges?

- Southwest Gas Stock: Dividend Potential

- What Are the Risks of Investing in Southwest Gas Stock?

- Southwest Gas Stock: Future Growth Prospects

- How to Buy Southwest Gas Stock?

- Southwest Gas Stock: Customer Satisfaction

- Why Should You Trust Southwest Gas Stock?

Is Southwest Gas Stock a Good Investment?

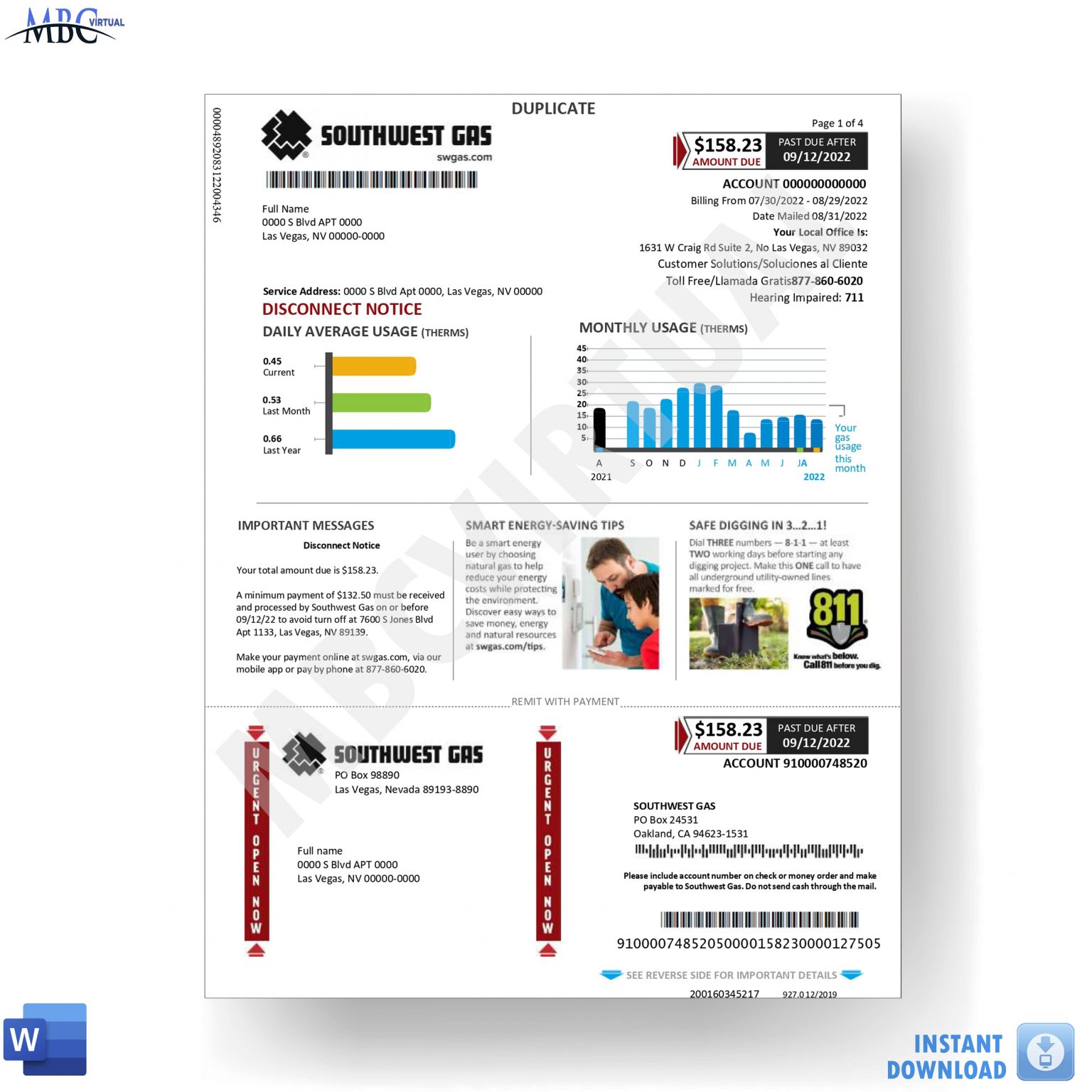

When evaluating Southwest Gas stock as a potential investment, it’s essential to consider the company’s historical performance and its role in the utility sector. Southwest Gas operates in a regulated industry, which means its revenue streams are relatively predictable. This stability makes Southwest Gas stock an attractive option for conservative investors seeking steady returns.

Read also:Dameon Pierce Injury What You Need To Know About The Latest Updates

One of the key factors that make Southwest Gas stock appealing is its focus on infrastructure development. The company has consistently invested in upgrading its pipelines and distribution systems, ensuring reliable service delivery. These investments not only enhance operational efficiency but also position the company for long-term growth. Investors often appreciate utility stocks like Southwest Gas stock for their resilience during economic downturns.

What Are the Key Metrics to Evaluate Southwest Gas Stock?

Before investing in Southwest Gas stock, it’s crucial to analyze key financial metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, and dividend yield. These metrics provide insights into the company’s profitability and valuation. Southwest Gas stock has maintained a solid track record of paying dividends, which is a significant draw for income-focused investors.

What Makes Southwest Gas Stock Unique?

Southwest Gas stock stands out in the utility sector due to its commitment to sustainability and innovation. The company is actively working on reducing its carbon footprint and exploring renewable energy solutions. This forward-thinking approach not only benefits the environment but also enhances the company’s reputation among socially conscious investors.

How Does Southwest Gas Stock Contribute to Sustainability?

Southwest Gas has implemented several initiatives to promote sustainability, such as investing in cleaner technologies and improving energy efficiency. These efforts align with global trends toward greener energy solutions, making Southwest Gas stock an appealing choice for investors who prioritize environmental responsibility.

Southwest Gas Stock: Financial Performance

Southwest Gas stock has demonstrated consistent financial performance over the years. The company’s revenue growth, driven by its expanding customer base and infrastructure investments, reflects its strong market position. Investors looking for stability and growth potential often find Southwest Gas stock to be a compelling option.

What Are the Revenue Drivers for Southwest Gas Stock?

The primary revenue drivers for Southwest Gas stock include its natural gas distribution services and infrastructure development projects. The company’s ability to maintain regulatory compliance and deliver reliable service has been instrumental in its financial success.

Read also:Discover The Best Deals At Dollar Store Princeton A Shoppers Guide

How Does Southwest Gas Stock Handle Market Challenges?

Like any company, Southwest Gas stock faces challenges such as fluctuating energy prices and regulatory changes. However, the company’s strategic planning and risk management practices have enabled it to navigate these challenges effectively. Southwest Gas stock’s resilience is a testament to its robust business model and experienced leadership team.

What Strategies Does Southwest Gas Stock Use to Mitigate Risks?

Southwest Gas employs a variety of strategies to mitigate risks, including diversifying its revenue streams, maintaining strong customer relationships, and investing in technology. These strategies help ensure that Southwest Gas stock remains a stable and reliable investment option.

Southwest Gas Stock: Dividend Potential

One of the most attractive features of Southwest Gas stock is its dividend potential. The company has a history of paying consistent dividends, which appeals to income-focused investors. Southwest Gas stock’s dividend yield is competitive within the utility sector, making it an excellent choice for those seeking passive income.

How Does Southwest Gas Stock Compare to Other Utility Stocks?

When compared to other utility stocks, Southwest Gas stock stands out for its stable dividend payments and growth-oriented initiatives. Investors often choose Southwest Gas stock for its balance of income generation and capital appreciation potential.

What Are the Risks of Investing in Southwest Gas Stock?

While Southwest Gas stock offers numerous benefits, it’s essential to be aware of the risks involved. Regulatory changes, environmental concerns, and economic fluctuations can impact the company’s performance. Investors should carefully assess these risks before adding Southwest Gas stock to their portfolios.

How Can Investors Mitigate Risks Associated with Southwest Gas Stock?

Investors can mitigate risks by diversifying their portfolios, staying informed about industry trends, and monitoring Southwest Gas stock’s financial performance. A well-rounded investment strategy can help minimize potential downsides.

Southwest Gas Stock: Future Growth Prospects

Southwest Gas stock is well-positioned for future growth, thanks to its focus on innovation and customer satisfaction. The company’s investments in technology and sustainability are expected to drive long-term value for shareholders. Investors who believe in the company’s vision may find Southwest Gas stock to be a rewarding investment.

What Are the Growth Opportunities for Southwest Gas Stock?

Growth opportunities for Southwest Gas stock include expanding its customer base, enhancing operational efficiency, and exploring new markets. The company’s strategic initiatives are designed to capitalize on these opportunities and deliver value to investors.

How to Buy Southwest Gas Stock?

Buying Southwest Gas stock is a straightforward process. Investors can purchase shares through a brokerage account or an online trading platform. It’s essential to conduct thorough research and consult with a financial advisor to ensure that Southwest Gas stock aligns with your investment goals.

What Are the Steps to Invest in Southwest Gas Stock?

To invest in Southwest Gas stock, follow these steps:

- Open a brokerage account.

- Research Southwest Gas stock’s performance and prospects.

- Decide on the number of shares to purchase.

- Place an order through your brokerage platform.

Southwest Gas Stock: Customer Satisfaction

Customer satisfaction is a critical factor in Southwest Gas stock’s success. The company has earned a reputation for delivering reliable and high-quality service, which has contributed to its strong customer retention rates. Investors often view customer satisfaction as a positive indicator of Southwest Gas stock’s long-term viability.

Why Is Customer Satisfaction Important for Southwest Gas Stock?

Customer satisfaction directly impacts Southwest Gas stock’s revenue and profitability. Happy customers are more likely to remain loyal, which ensures a steady revenue stream for the company. This stability is a key reason why investors trust Southwest Gas stock.

Why Should You Trust Southwest Gas Stock?

Trust in Southwest Gas stock is built on the company’s long-standing reputation, financial stability, and commitment to innovation. The company’s leadership team has a proven track record of navigating challenges and delivering value to shareholders. For investors seeking a reliable utility stock, Southwest Gas stock is a trustworthy choice.

What Makes Southwest Gas Stock a Trustworthy Investment?

Southwest Gas stock’s transparency, regulatory compliance, and focus on sustainability make it a trustworthy investment. The company’s dedication to its customers and shareholders reinforces its position as a leader in the utility sector.