Investing in the stock market can be both rewarding and challenging, especially when volatility comes into play. For traders and investors looking to capitalize on declining volatility, the inverse VIX ETF offers a unique opportunity. These exchange-traded funds are designed to profit when the Volatility Index (VIX), often referred to as the "fear gauge," decreases. Understanding how inverse VIX ETFs work and the risks involved is crucial for anyone considering this investment strategy. This guide will explore everything you need to know about inverse VIX ETFs, from their mechanics to their potential benefits and drawbacks.

Inverse VIX ETFs are financial instruments that aim to deliver the opposite performance of the VIX index. When market volatility drops, these ETFs tend to rise in value, making them attractive to traders who anticipate a calm market environment. However, these products are not without risks. Due to their complex structure and reliance on derivatives, inverse VIX ETFs can be highly volatile and may not be suitable for long-term investors. This article will break down the key aspects of inverse VIX ETFs to help you make informed decisions.

Whether you're a seasoned trader or a beginner, understanding the intricacies of inverse VIX ETFs is essential. These ETFs are not like traditional investments and require a solid understanding of market dynamics. In the following sections, we’ll delve deeper into how these products work, their potential advantages, and the risks you should be aware of. By the end of this article, you’ll have a clearer picture of whether inverse VIX ETFs align with your investment goals.

Read also:Unlocking Growth Potential A Comprehensive Guide To Canadian Banks Etf

- What is an Inverse VIX ETF?

- How Does an Inverse VIX ETF Work?

- Is an Inverse VIX ETF Right for You?

- What Are the Benefits of Investing in an Inverse VIX ETF?

- What Are the Risks of Inverse VIX ETFs?

- How to Invest in an Inverse VIX ETF?

- Key Factors to Consider Before Investing

- How Has the Inverse VIX ETF Performed Historically?

- What Are the Common Misconceptions About Inverse VIX ETFs?

- Final Thoughts on Inverse VIX ETFs

What is an Inverse VIX ETF?

An inverse VIX ETF is a type of exchange-traded fund that aims to deliver the opposite performance of the CBOE Volatility Index (VIX). The VIX measures market expectations of near-term volatility and is often used as a gauge of investor sentiment. When the VIX declines, inverse VIX ETFs are designed to rise in value, allowing investors to profit from a decrease in market volatility.

These ETFs use financial derivatives, such as futures contracts, to achieve their objectives. While they can be a powerful tool for short-term trading, they are not intended for long-term investment due to their complex structure and potential for significant losses.

How Does an Inverse VIX ETF Work?

Inverse VIX ETFs operate by using leverage and derivatives to achieve their goals. They typically invest in VIX futures contracts or other financial instruments that move inversely to the VIX. For example, if the VIX decreases by 1%, an inverse VIX ETF might increase by 1% or more, depending on its leverage.

However, it's important to note that these ETFs reset daily, meaning their performance over longer periods may not match the inverse of the VIX's performance. This daily reset can lead to compounding effects, which may result in significant deviations from expected returns over time.

Is an Inverse VIX ETF Right for You?

Investing in an inverse VIX ETF requires a high level of market knowledge and risk tolerance. These products are best suited for experienced traders who understand the intricacies of volatility trading and are comfortable with the potential for rapid losses. If you're a long-term investor, inverse VIX ETFs may not align with your goals due to their short-term focus and inherent risks.

What Are the Benefits of Investing in an Inverse VIX ETF?

There are several potential advantages to investing in an inverse VIX ETF:

Read also:Smu Vs Alabama A Comprehensive Analysis Of The Rivalry And Key Matchups

- Profit from Declining Volatility: Inverse VIX ETFs allow investors to benefit when market volatility decreases.

- Hedging Opportunities: These ETFs can be used as a hedge against other volatile investments in your portfolio.

- Liquidity: Inverse VIX ETFs are traded on major exchanges, providing easy access and liquidity.

What Are the Risks of Inverse VIX ETFs?

While there are potential benefits, inverse VIX ETFs come with significant risks:

- High Volatility: These ETFs can experience extreme price swings due to their reliance on derivatives.

- Compounding Effects: The daily reset mechanism can lead to performance deviations over time.

- Unsuitable for Long-Term Investment: Inverse VIX ETFs are designed for short-term trading and may not perform well over extended periods.

How to Invest in an Inverse VIX ETF?

To invest in an inverse VIX ETF, you’ll need a brokerage account that allows trading in ETFs. Once you’ve opened an account, you can search for inverse VIX ETFs by their ticker symbols and place buy or sell orders. It’s essential to conduct thorough research and understand the specific ETF’s objectives, fees, and risks before investing.

Key Factors to Consider Before Investing

Before investing in an inverse VIX ETF, consider the following factors:

- Market Conditions: Assess whether the market environment is conducive to declining volatility.

- Fees and Expenses: Be aware of the management fees and other costs associated with the ETF.

- Risk Tolerance: Evaluate your ability to withstand potential losses.

How Has the Inverse VIX ETF Performed Historically?

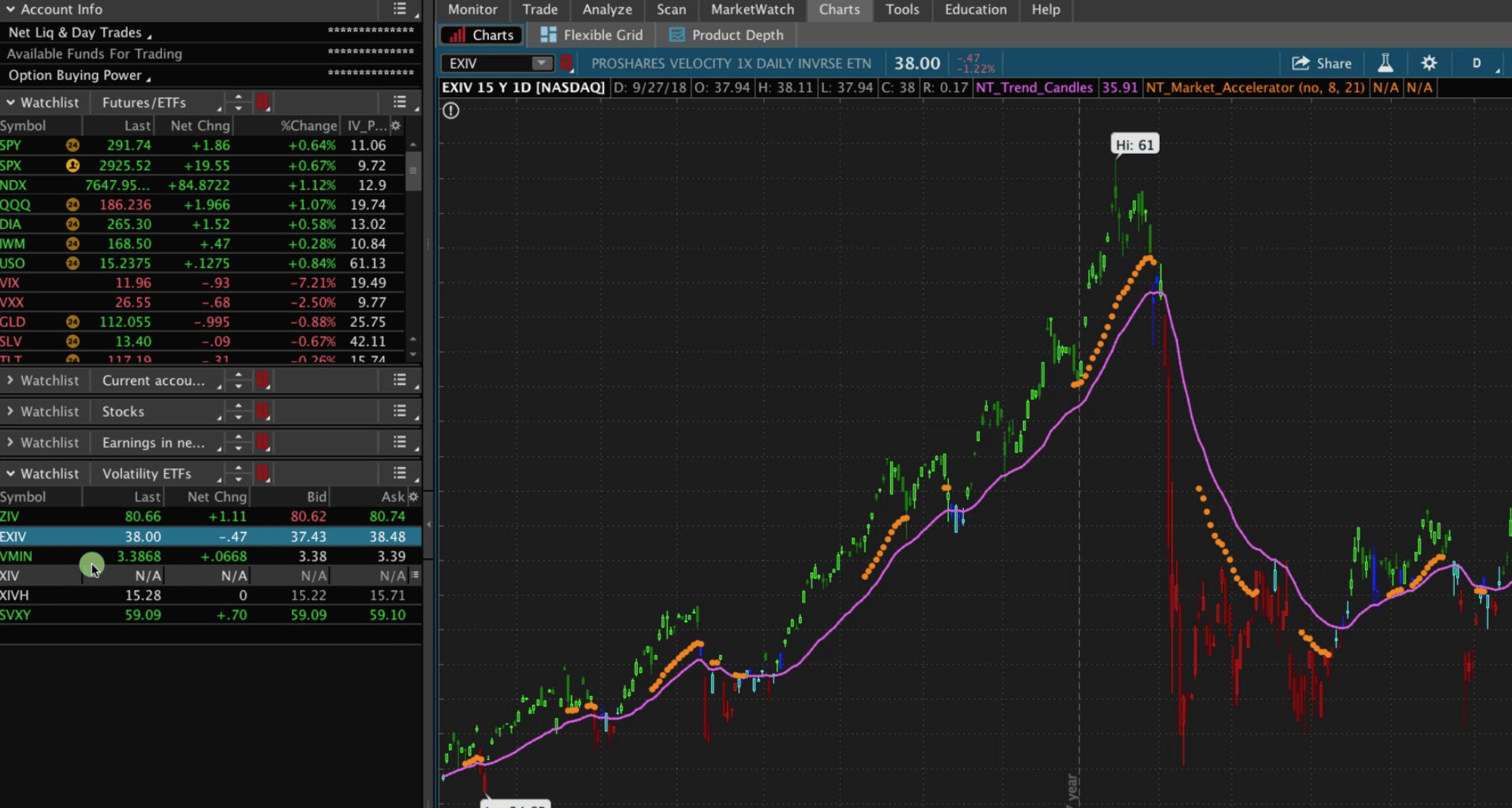

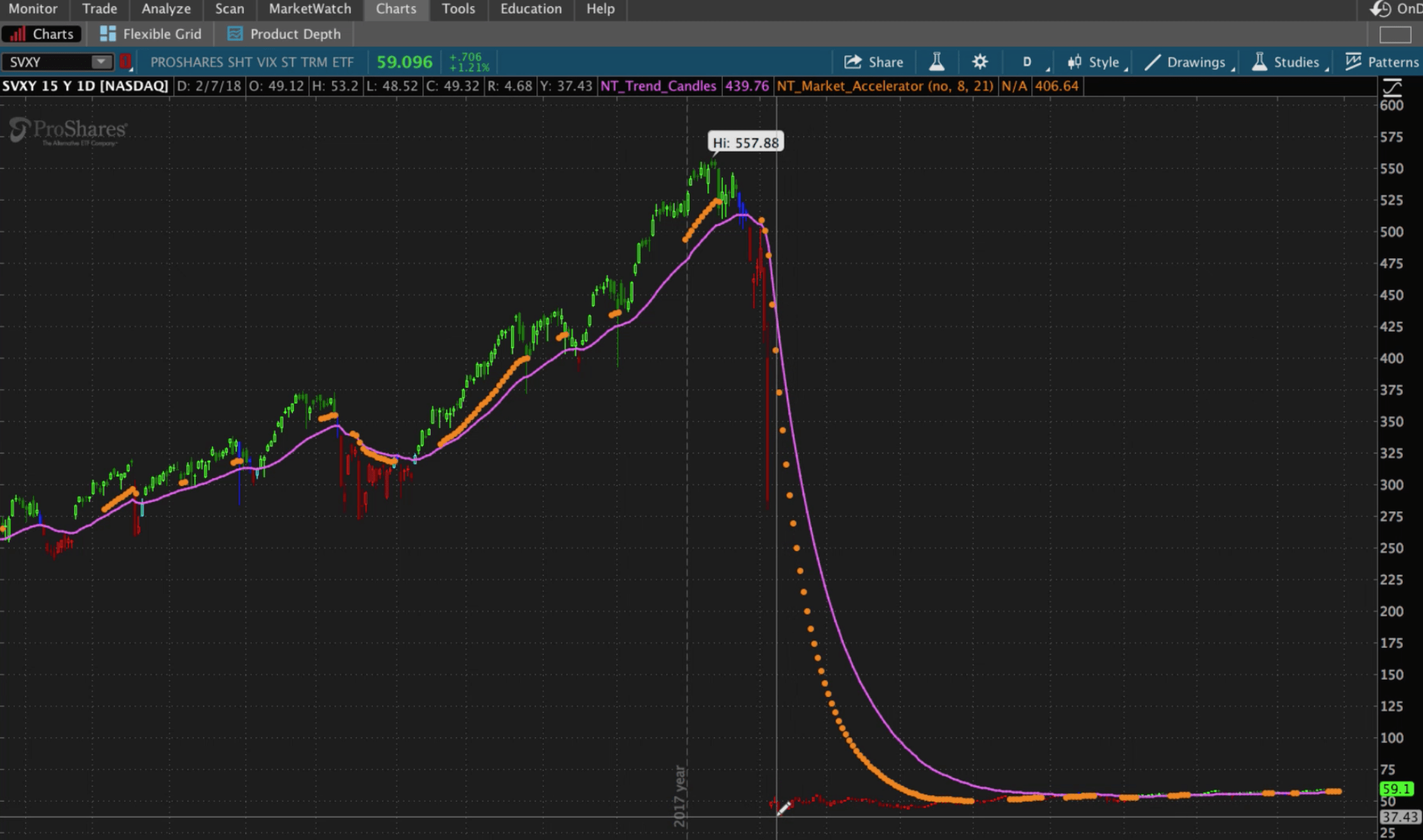

The performance of inverse VIX ETFs can vary significantly depending on market conditions. During periods of declining volatility, these ETFs tend to perform well. However, during times of heightened volatility, they can experience substantial losses. Historical data shows that inverse VIX ETFs are highly sensitive to changes in the VIX and should be approached with caution.

What Are the Common Misconceptions About Inverse VIX ETFs?

There are several misconceptions about inverse VIX ETFs that investors should be aware of:

- They Are Safe Investments: Inverse VIX ETFs are not low-risk investments and can lead to significant losses.

- They Perform Well Long-Term: Due to their daily reset mechanism, these ETFs are not designed for long-term holding.

- They Are Suitable for All Investors: These products are best suited for experienced traders, not beginners.

Final Thoughts on Inverse VIX ETFs

Inverse VIX ETFs offer a unique way to profit from declining market volatility, but they come with significant risks and complexities. Before investing, it’s crucial to conduct thorough research, understand the mechanics of these products, and assess your risk tolerance. While they can be a valuable tool for experienced traders, they are not suitable for everyone. By staying informed and making educated decisions, you can determine whether inverse VIX ETFs align with your investment strategy.