Are you considering diversifying your investment portfolio by exploring the real estate tech industry? If so, you might want to take a closer look at Opendoor stock. Opendoor Technologies Inc. has emerged as a game-changer in the real estate sector, leveraging technology to simplify the home-buying and selling process. As a publicly traded company, Opendoor offers investors a unique opportunity to participate in the growth of a business that is transforming how people buy and sell homes. With the real estate market constantly evolving, understanding the potential of Opendoor stock could be a smart move for both seasoned and novice investors alike.

Opendoor’s innovative approach to real estate transactions has attracted significant attention from investors and homeowners alike. By allowing sellers to receive instant offers on their homes and buyers to access a streamlined purchasing process, Opendoor has positioned itself as a leader in the iBuying industry. This has not only disrupted traditional real estate models but has also opened up new possibilities for investors looking to capitalize on the intersection of technology and real estate. If you’re wondering whether now is the right time to buy Opendoor stock, this article will guide you through the essential factors to consider before making your decision.

Investing in stocks like Opendoor requires careful research and an understanding of the company’s business model, market trends, and financial performance. As you explore the potential of Opendoor stock, it’s crucial to weigh the risks and rewards, analyze the company’s growth trajectory, and assess how it fits into your overall investment strategy. Whether you’re a long-term investor or someone looking for short-term gains, this guide will provide you with the insights you need to make an informed decision about buying Opendoor stock.

Read also:Discover The Expertise Of James Fischkoff Md A Trusted Name In Medicine

Table of Contents

- What is Opendoor?

- Why Should You Consider Buying Opendoor Stock?

- How Does Opendoor Work?

- Is Opendoor Stock a Good Investment?

- What Are the Risks of Buying Opendoor Stock?

- How is Opendoor’s Financial Performance?

- Who Are Opendoor’s Main Competitors?

- How to Buy Opendoor Stock?

- What Does the Future Hold for Opendoor Stock?

- Conclusion: Should You Buy Opendoor Stock?

What is Opendoor?

Opendoor Technologies Inc. is a real estate technology company that simplifies the process of buying and selling homes. Founded in 2014 by Eric Wu, the company has revolutionized the real estate industry by offering an iBuying platform that allows homeowners to sell their properties quickly and hassle-free. Opendoor purchases homes directly from sellers, makes necessary repairs, and then resells them to buyers. This innovative model eliminates the need for traditional real estate agents and reduces the time and stress associated with selling a home.

Why Should You Consider Buying Opendoor Stock?

Investing in Opendoor stock can be an appealing option for those looking to tap into the growing real estate technology sector. Opendoor’s business model addresses a significant pain point in the real estate market by offering convenience and transparency to both buyers and sellers. As the demand for tech-driven solutions in real estate continues to rise, Opendoor is well-positioned to capitalize on this trend. But what makes Opendoor stock stand out from other investment opportunities?

How Does Opendoor Work?

Opendoor’s platform operates on a simple yet effective model. Homeowners can request an offer for their property through the Opendoor website or app. Using advanced algorithms and data analytics, Opendoor provides an instant cash offer based on the home’s condition, location, and market trends. Once the offer is accepted, Opendoor handles the closing process, repairs, and eventual resale of the property. This seamless process has made Opendoor a popular choice for homeowners looking to sell quickly.

Is Opendoor Stock a Good Investment?

Before you decide to buy Opendoor stock, it’s essential to evaluate its potential as an investment. Opendoor has shown impressive growth since going public, but like any stock, it comes with its own set of risks and rewards. Let’s explore some key factors to consider.

What Are the Growth Prospects for Opendoor Stock?

Opendoor’s growth prospects are closely tied to the expansion of the iBuying market and the increasing adoption of technology in real estate. As more consumers seek convenience and efficiency in home transactions, Opendoor is well-positioned to benefit from this trend. Additionally, the company’s focus on data-driven decision-making and operational efficiency could drive long-term profitability.

What Are the Risks of Buying Opendoor Stock?

While Opendoor offers exciting opportunities, there are risks to consider before you buy Opendoor stock. The real estate market is inherently cyclical, and economic downturns can impact Opendoor’s business. Additionally, the company faces stiff competition from other iBuying platforms and traditional real estate agents. Investors should carefully assess these risks before making a decision.

Read also:Fayetteville Ga Water A Comprehensive Guide To Clean Water And Community Resources

How is Opendoor’s Financial Performance?

Opendoor’s financial performance is a critical factor to consider when evaluating its stock. The company has reported steady revenue growth, driven by an increase in home transactions and market expansion. However, Opendoor has also faced challenges, including rising operational costs and fluctuating profit margins. Analyzing the company’s financial statements and earnings reports can provide valuable insights into its long-term viability.

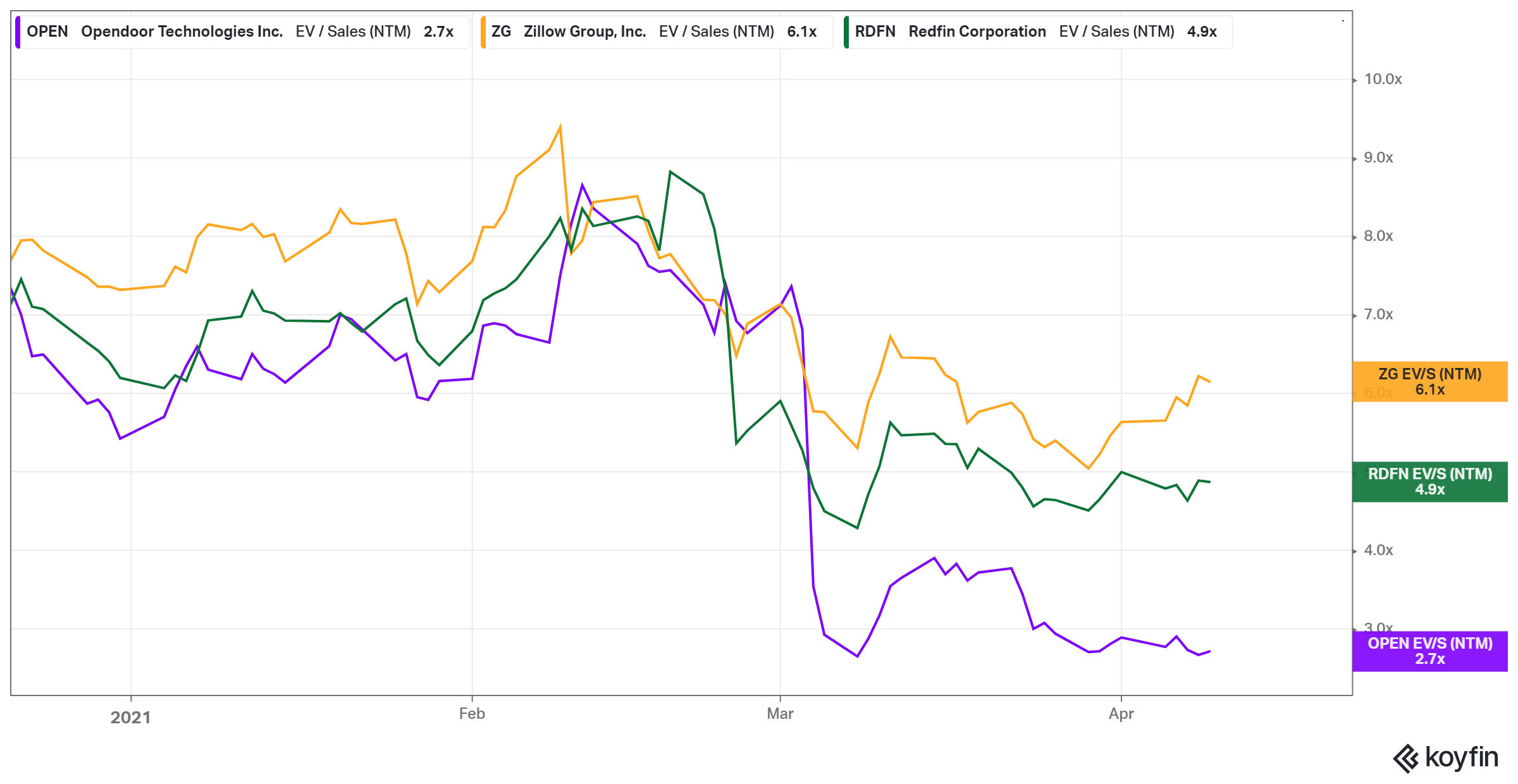

Who Are Opendoor’s Main Competitors?

Opendoor operates in a competitive landscape, with companies like Zillow Offers, Offerpad, and Redfin competing for market share. Each of these companies offers a similar iBuying service, making it essential for Opendoor to differentiate itself through innovation and customer experience. Understanding Opendoor’s competitive position can help investors assess its potential for sustained growth.

How to Buy Opendoor Stock?

Buying Opendoor stock is a straightforward process. You can purchase shares through an online brokerage account or a stock trading app. Here’s a step-by-step guide to help you get started:

- Open a brokerage account if you don’t already have one.

- Fund your account with the amount you wish to invest.

- Search for Opendoor Technologies Inc. (NASDAQ: OPEN) in the stock market.

- Place an order to buy shares at your desired price.

- Monitor your investment and make adjustments as needed.

What Does the Future Hold for Opendoor Stock?

The future of Opendoor stock looks promising, with the company continuing to innovate and expand its services. Opendoor is investing in technology to enhance its platform and improve the customer experience. Additionally, the company is exploring new markets and partnerships to drive growth. However, investors should remain cautious and stay informed about market trends and economic conditions that could impact Opendoor’s performance.

Conclusion: Should You Buy Opendoor Stock?

Deciding whether to buy Opendoor stock ultimately depends on your investment goals and risk tolerance. Opendoor offers a unique opportunity to invest in a company that is reshaping the real estate industry. By conducting thorough research and staying informed about market trends, you can make an informed decision about whether Opendoor stock aligns with your financial objectives. Remember, investing in stocks always carries risks, so it’s essential to consult with a financial advisor before making any investment decisions.